Forex Trading

What is a Risk? 10 definitions from different industries and standards

Risk-return tradeoff is a fundamental trading principle describing the inverse relationship between investment risk and investment return. A well-diversified portfolio will consist of different types of securities from diverse industries that have varying degrees of risk and correlation with each other’s returns. The most basic—and effective—strategy for minimizing risk isdiversification.

However, every decision about a new product offering, a new target market, or a potential merger has the potential to fail and put the company’s ability to operate at risk. The reputation of HSBC faltered in the aftermath of the fine it was levied for poor anti-money laundering practices. Physical risks point to all those risks that present a threat to the business property, material assets, and human resources like fire, theft, water damages, and risk to employees. This type of risk will lead to expenses in the form of cost of repair or replacement. These causes include risks that may result due to human error.

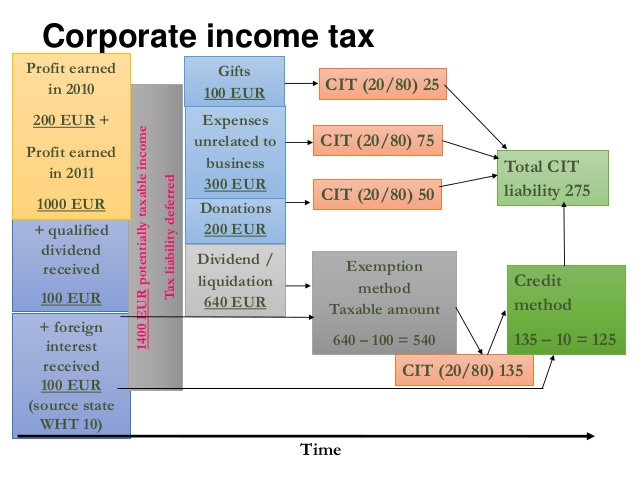

For the risks that can be quantified, a company can use ratio analysis. For example, a company can use various liquidity ratios, or leverage ratios, or profitability ratios. A point to note is that different situations will require the use of different ratios.

Oftentimes, all types of investors will look to these securities for preserving emergency savings or for holding assets that need to be immediately accessible. By that point, it was clear that Toyota needed to put a new emphasis on risk management. Risk management entails forecasting and assessing financial risks, as well as devising mitigation or avoidance strategies. Small businesses benefit from operational flexibility and the ability to adapt quickly to changing conditions, making them less vulnerable to business risks. On the other hand, as a company grows in size, its flexibility decreases.

If a new product doesn’t sell well, there’s always a more significant business risk of running out of business. This can be done either before the business begins operations or after it experiences a setback. Ideally, a risk management strategy will help the company be better prepared to deal with risks as they present themselves.

How to Avoid or Minimize?

Business risk is the exposure a company or organization has to factor that will lower its profits or lead it to fail. Anything that threatens a company’s ability to achieve its financial goals is considered a business risk. There are many factors that can converge to create business risk. Sometimes it is a company’s top leadership or management that creates situations where a business may be exposed to a greater degree of risk.

If you use a tool a lot, you should always watch how long you use it. There is a good chance this tool will break down if it isn’t used very often. Stand out and gain a competitive edge as a commercial banker, loan officer or credit analyst with advanced knowledge, real-world analysis skills, and career confidence. what do you mean by business risk How effectively management is able to identify and reach its target market. Ryan Eichler holds a B.S.B.A with a concentration in Finance from Boston University. He has held positions in, and has deep experience with, expense auditing, personal finance, real estate, as well as fact checking & editing.

- For example, there is a possibility of loss if the company invests by making a stock purchase.

- Such forces make it impossible for businesses to avoid risk completely as they are unpredictable and can’t be controlled by the business.

- After that, the restaurant was temporarily closed for repairs and restoration.

- For instance, crop insurance is a novel form of insurance becoming popular in all the countries.

- What is significant about the decision tree approach is that it does several things for decision makers.

- The basic advantage of a tree diagram is that another act subsequent to the happening of each event may also be represented.

Beside the risks cited above, there are also other risks to which businessmen are exposed. Every company has its own objectives and goals and aims at a particular gross profit and operating income. It expects itself to pay to its shareholders a certain rate of dividend and plough back some profits. Market competition, changes in customers demand and changes to government or market policies. Sources, such as a poor management structure, bad publicity, theft, or the loss of talented employees.

Risk Management

The risks arising due to these reasons can be insured and the resultant loss can be avoided. Besides, there is a time gap between production and distribution. The businessman has to face several risks before distribution of the product. For example, suppose operating incomes are expected to be 10% in a year, business risk would be low when operating income varies between 9 and 11%. If the operating income is as low as 5% or as high as 16%, then the business risk is high.

Business risk is different from financial risk, which occurs when a company employs significant debt in its capital structure. This type of risk has the potential not only to hurt your profits but can also put your company out of business. Employee Involvement A company must involve employees in its decision-making.

Types of Business Risk

A risk manager must try to identify the risks that other companies in the same industry face. If others face it, there are good chances that your company may also meet the same risk. And, if a company fails to come up with one, then it could face the consequences. For example, BlackBerry was the leader in the smartphone segment earlier.

Technically risk can be defined as a situation where the possible consequences of the decision that is to be taken are known. Both risks serve as a warning sign that something is wrong with the firm. So if any indicator, such as EBIT , debt-to-equity ratio, or any other indicator, shows a deterioration, it should be seen as a red flag. Business risk refers to operating expenses such as wages, production costs, rent, electricity, etc. Financial risk refers to loan interest, principal repayment, and more.

First, there is economic uncertainty, or it can also be called economic uncertainty caused. The second uncertainty is caused by nature, commonly referred to as nature uncertainty caused. Finally, there is the uncertainty resulting from human behavior, or human delay caused in other terms. Industry-specific risks, like the level of concentration in the industry, regulatory risk, barriers to entry, the threat of disruption, and other factors. The second form of business risk is referred to as compliance risk. Compliance risk primarily arises in industries and sectors that are highly regulated.

Features of Business Risk

As soon as a risk manager sees any problem, he or she must not wait for it to become a threat. These are the causes on which human beings have no control. For example, an earthquake, virus outbreak, flood, and more.

The losses which can be made good or losses for which company can get compensation from the insurance company are called Insurable Risks. Business risk is the possibilities a company will have lower than anticipated profits or experience a loss rather than making a profit. Business risk is influenced by numerous factors, including sales volume, per-unit price, input costs, competition, and the overall economic climate and government regulations. One can evaluate business risk by considering the company’s earnings before taxes or EBIT. We can use the debt-to-asset ratio, the interest coverage ratio, the debt service coverage ratio, or the debt-to-equity ratio to evaluate financial risk. A company has to deal with many risks, and two of the most important risks are business and financial risks.

You should be aware of external as well as internal risks. It will bid you well to jot down these risks beforehand and come up with effective strategies to mitigate or remove such risks when they arise. The first and foremost thing that a company should do is identifying all the sources that can present risk in the future.

The coefficient of variation of project B is more as compared to project A. A project having a larger standard deviation will be more risky as compared to a project having smaller standard deviation. In the above illustration, the standard deviation for project A is 1,095 while that of project B is 2,098. Pioneer Company Ltd. has given the following possible cash inflows for two of their projects A and B. Both the projects will require an equal investment of Rs. 5,000. Let us compute expected monetary values for the projects A and B.

Business Risk Causes

The external business environment, which includes macroeconomic influences outside management’s control . In the market, it is a big chance to lose its customer base. For example, if a car company is blamed for launching cars without proper safety features, it would be a reputational risk for the company.